If you’re staring up at a damaged roof and wondering, “Will my insurance actually pay for this?”—you’re not alone. It’s one of the most common questions we hear from homeowners, especially after a major storm rolls through and roof damage shows up unexpectedly.

The truth? Sometimes homeowners insurance covers your roof replacement—and sometimes it doesn’t. It depends on what caused the damage, how old your roof is, and the type of insurance policy you have. Learn more about homeowners insurance basics from NAIC.

In this guide, we’ll cover what kind of roof damage is usually covered by insurance, what’s excluded, and how to give yourself the best shot at getting your roof insurance claim approved. For more helpful resources, visit our RoofScope blog.

When Does Homeowners Insurance Cover Roof Damage?

Most standard homeowners insurance policies will cover roof damage—but only when it’s caused by a sudden, accidental event (often called a “covered peril”). These commonly include:

Windstorms or tornadoes

Hail damage

Fire

Falling trees or branches

Ice or snow collapse

Vandalism

If your shingles were torn off in a windstorm or a tree branch smashed your roof during a snowstorm, your insurance policy likely provides coverage. Still, the amount you’re reimbursed can depend on the roof’s condition before the incident and your deductible.

What Roof Damage Is Not Covered by Insurance?

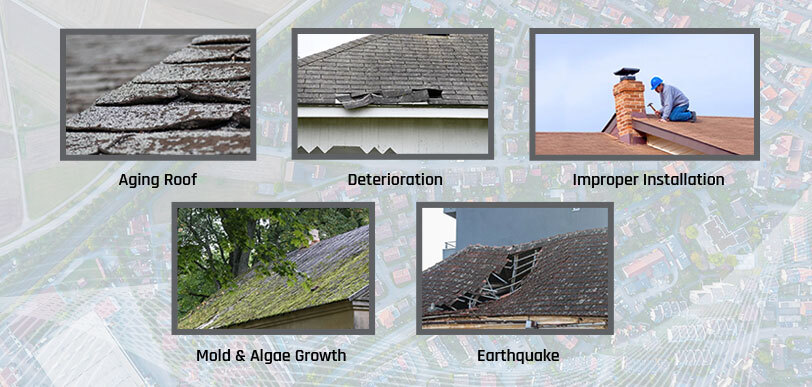

There’s a catch: insurance typically won’t cover roof issues that result from age, neglect, or poor maintenance. That means damage due to:

General wear and tear from an aging roof

Poor roof maintenance or visible signs of deterioration

Improper installation

Mold, algae growth, or pest infestations

Flood or earthquake damage without additional coverage

If your roof is simply old and deteriorating, your insurance company may decline the claim—even if you believe a storm made it worse.

Understanding Your Coverage: RCV vs. ACV

When it comes to roof replacement coverage, most homeowners insurance policies fall into one of two categories: see how Allstate explains the difference.

-

Replacement Cost Value (RCV): This covers the full cost to replace your roof with similar materials—no depreciation deducted.

-

Actual Cash Value (ACV): This pays out the current value of your roof after subtracting for age and condition, which means a lower reimbursement.

If you're unsure which one applies to you, check your policy’s declarations page or speak with your insurance agent. It makes a big difference when filing a roof damage claim.

How to Handle a Roof Damage Insurance Claim

Follow these simple steps to give yourself the best chance at a successful claim. Here’s a helpful guide from the Insurance Information Institute (III).

1. Take Photos Immediately

Document everything before repairs begin—missing shingles, torn flashing, visible debris, and any signs of interior leaks.

2. Get a RoofScope Report

Our aerial roof measurement reports deliver accurate documentation of your roof’s size and shape. They’re accepted by insurance companies and help eliminate any guesswork during your claim.

3. File Your Insurance Claim Promptly

Call your insurance provider, open a claim, and set up an inspection with their adjuster. Submitting your RoofScope report early can help speed up the process.

4. Work With a Roofing Contractor Familiar With Insurance Claims

A good contractor can help you navigate the process, provide their own assessment, and even advocate on your behalf during the adjuster's visit.

Why RoofScope Reports Matter in Roof Insurance Claims

When it comes to a roof damage claim, precision and proof matter. Insurance adjusters are looking for solid documentation, not vague estimates. RoofScope reports offer:

Turnaround in 24 hours or less

CAD-verified measurements for accuracy

Compatibility with major insurance carriers

Detailed imagery and diagrams included

Think of it as a rock-solid foundation for your claim—backed by trusted aerial measurement technology.

FAQs: Roof Insurance Coverage

Will a roof insurance claim raise my premium?

It can, depending on your insurer and your claims history. One claim might not impact your rate, but multiple claims over time often will.

Is partial damage enough for full roof replacement?

If repairs can’t restore your roof’s full functionality—or if the structural integrity is compromised—your insurance might approve a full replacement.

What if my claim gets denied?

You can appeal. A second opinion from a licensed contractor or additional evidence like a RoofScope report can support your case.

Final Thoughts on Homeowners Insurance and Roof Replacement

We’ve helped hundreds of homeowners navigate the roof insurance process—and we’ve seen how much smoother it goes with the right documentation in hand. Whether it’s a storm, hail damage, or a fallen branch, your best first move is making sure your claim starts with the facts.

Let RoofScope help you document your roof damage clearly, quickly, and accurately. It could make all the difference in getting your claim approved—and getting your home back to normal.

written by RoofScope published on 03. 28. 2025